virginia tesla tax credit

The best place to start is probably Teslas Design Studio. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Irs Clean Energy Tax Credits Electric Vehicles Irc 30d

This vehicle came equipped with electric powertrain technology.

. Two proofs of Virginia residency. You trade in your old vehicle and receive a 6000 credit. Some electric cars are eligible for a 7500 tax credit and other rebates and incentives which are usually only available if you buy a new EV.

Some states like Colorado and Virginia offer state tax credits over 5000 dollars to entice customers to buy electric vehicles. Teslas production in the country also slid 81 to 10757 vehicles in April compared with 55462 in March. Reuters the news and media division of Thomson Reuters is the worlds largest multimedia news provider reaching billions of people worldwide every day.

A W-2 IRS tax form. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. A mortgage statement or lease agreement.

Specific states like Virginia and Colorado offer a state tax credit of at least 5000 when you buy an electric car. A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. A utility bill less than 60 days old.

Zacks free daily newsletter Profit from the Pros provides 1 Rank Strong Buy stocks etfs and more to research for your financial portfolio. Tesla has managed to come out of the recession with ever increasing stock prices. Postal Service change of address confirmation form.

Tesla is branching out into other countries now too but the success in these locations depends on the local economy. The federal government also offers a 7500 tax credit for purchasing electric vehicles. For the best experience we recommend upgrading or changing your web browser.

Go Online to Teslas Website. The maximum credit is 500 for vehicles with a gross vehicle weight rating GVWR of 10000 pounds lbs or less and 1000 for vehicles with a GVWR of more than 10000 lbs. Currently Teslas arent eligible for the federal tax credit but depending on where you live you may be able to benefit from other incentives.

Tesla is accelerating the worlds transition to sustainable energy with electric cars solar and integrated renewable energy solutions for homes and businesses. In Virginia you still have to pay sales tax on the 15000 you paid for the vehicle before trade-in. The out-of-pocket cost for the new vehicle is 9000 after trade-in.

The area with the highest local tax in Virginia is York County with a 270 local sales tax. The public lent a. We would like to show you a description here but the site wont allow us.

Tesla didnt export any Shanghai-made vehicles in April compared with 60 exported in March. This tax credit can apply to your entire Tesla solar system purchase in 2022 including the Powerwall. We would like to show you a description here but the site wont allow us.

Model 3 Order Online. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Official correspondence from a federal state or local government agency.

Electric Vehicles Solar and Energy Storage. Through the companys website or its in-person show rooms. Unfortunately Teslas arent currently eligible for the tax credit.

The automaker now manufactures four different models. A lien serves to guarantee an underlying obligation such as the repayment of a loan. Local and Utility Incentives.

Tesla offers two ways to buy its cars. Tesla has already maxed out its quota so youll have to wait for the EV tax credit to be re-introduced or extended before you can make use of it. On the other hand.

Reuters provides business financial. Example If you were to buy a 25000 car and had a trade-in worth 15000 your sales tax would be on 10000 instead of the full 25000. In addition to the federal tax credit some state and local governments also have incentives in place to help people lower the total cost of a.

An employer-issued payroll check stub showing the full SSN. Child Tax Credit to revert to original form for 2022. In both cases youll likely order a car not buy it on the spot.

You may even qualify for a specific tax credit for buying an electric car. States that do not have a trade-in tax credit policy do not get any tax savings. We would like to show you a description here but the site wont allow us.

As the Child Tax Credit was enhanced for just one year and without further expansion or adoption of Bidens Build Back Better framework this. Given the price of Teslas systems you could expect to save more than 9000 with the tax credit. Thats because the credit is phased out after a certain number of cars are produced by each manufacturer.

Read Teslas 2021 Impact Report. Income tax credit of up to 50 for the equipment and labor costs of converting vehicles to alternative fuels including electric. Tesla was founded in 2003 and released the Roadster five years later.

Why You Can T Buy A Tesla In Some States

Virginia Sales Tax On Cars Everything You Need To Know

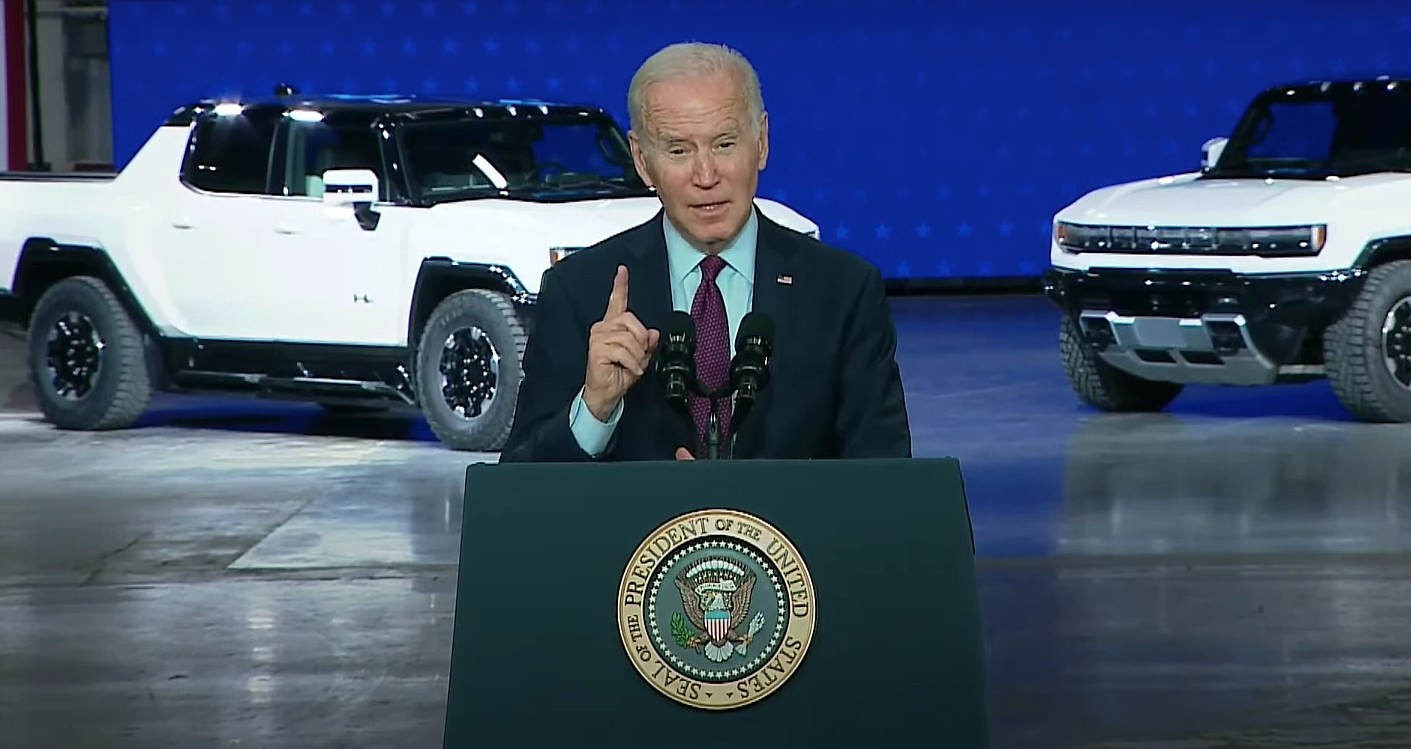

Manchin Objects To Federal Tax Credit For Union Made Electric Vehicles A Provision Of Biden S Social Spending Package The Washington Post

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Pohanka Lexus Tesla Maintenance

Tax Credit For Electric Vehicle Chargers Enel X

Charging Stations South Carolina Dominion Energy

The Fuse Can 2019 Match The Ev Market S 2018 Highs The Fuse

Used Tesla For Sale In Columbus Oh Cars Com

Virginia State And Federal Tax Credits For Electric Vehicles In Fredericksburg Va Pohanka Hyundai Of Fredericksburg

Solved Electric Vehicle Tax Credit

Us President Biden S Union Friendly 4 500 Ev Tax Credit Buff Is Facing A Big Challenge

Why You Can T Buy A Tesla In Some States

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Biden S Electric Vehicle Plan Faces Jam From Cultural Divide 2022 02 03 Supplychainbrain

The Biggest Mistakes Buyers Make When Shopping For An Electric Car Marketwatch